Introduction

As 2026 begins, a big change is happening for accountants in the UK. A new rule called Making Tax Digital (MTD) has just started. This means people must use computers to report their taxes instead of paper. Because everything is moving online, accountants can’t just be good at numbers anymore. They must be great at talking to people on the internet.

Social media marketing for accounting firms is no longer a “nice to have.” It is now a must-have part of the job. Instead of just checking numbers, accountants now compete to show they are helpful, trusted, and skilled with digital tools. This guide explains how they can reach people online while following all the important legal rules for professional businesses.

The Market in 2026: A Big Moment for the Profession

The start of 2026 is a busy time. Energy prices are high, interest rates are up, and new government budget rules from last year are now in place. Accountants now have two big jobs to do at the same time.

The two priorities every UK accounting firm faces right now:

- Help clients who are not yet comfortable with digital tools

- Help others use new technology to save time and cut admin

61% of UK accounting firms say growing their business is their top priority in 2025/26. To do this, they are using LinkedIn and YouTube to build trust and explain complicated ideas to their clients.

Moving Toward a Digital World

HMRC wants 90% of its support to be online by 2030. When an accountant uses social media to explain these big changes, they are not just selling services. They are genuinely helping the public.

About 1 million people need to follow the new April 2026 tax rules. Social media is one of the fastest ways to get the right information.

However, being online also means accountants must follow strict rules so they don’t make mistakes or break any laws while posting.

How Accountants Can Build a Social Media Strategy

In 2026, accounting has shifted from “just doing the paperwork” to “giving helpful advice before there’s a problem.” Your online presence is now your front door.

75% of business buyers look at social media before hiring someone. Successful firms spend much more on digital content and ads than slower-growing ones. Helpful posts build trust before a potential client ever makes contact.

The new approach is called “social selling.” This means sharing smart tips and connecting with people online to show that the firm is both knowledgeable and approachable. By covering topics that worry about small business owners, like the National Minimum Wage rising to £12.71 per hour, accountants prove they are not just “numbers of people” in a back office.

They become important partners who help businesses plan and succeed. A strong social media strategy for accountants puts this kind of educational content at its centre.

Regulatory Compliance: GDPR and Social Media for UK Accountants

If you are a UK accountant, following data privacy rules under GDPR is essential when using the internet to find new clients. In 2025, the ICAEW rules got stricter. Accountants must now work harder to keep private information safe from the moment they receive it until it gets deleted.

This matters most when using social media for lead generation. It is easy to mix up public conversations with private data by accident. The key rules to follow are simple:

- Only ask for what you need, like a name and an email address

- Tell people clearly why you are collecting their information and how you will use it

- Move any data collected through social media into a secure, encrypted system straight away

GDPR at a Glance: What It Means for Social Media

| GDPR Element | Application to Social Media | 2026 Professional Standards |

|---|---|---|

| Lawful Basis | Consent must be clear and informed for marketing. | Be straightforward and honest about data use. |

| Transparency | Privacy notices must be visible at the point of capture. | Comply with laws to avoid hurting the profession. |

| Data Security | Use encrypted transfer protocols for leads. | Duty to preserve information across the full lifecycle. |

| Purpose Limitation | Data collected for a guide cannot be used for cold calls. | Act in a way that maintains trust. |

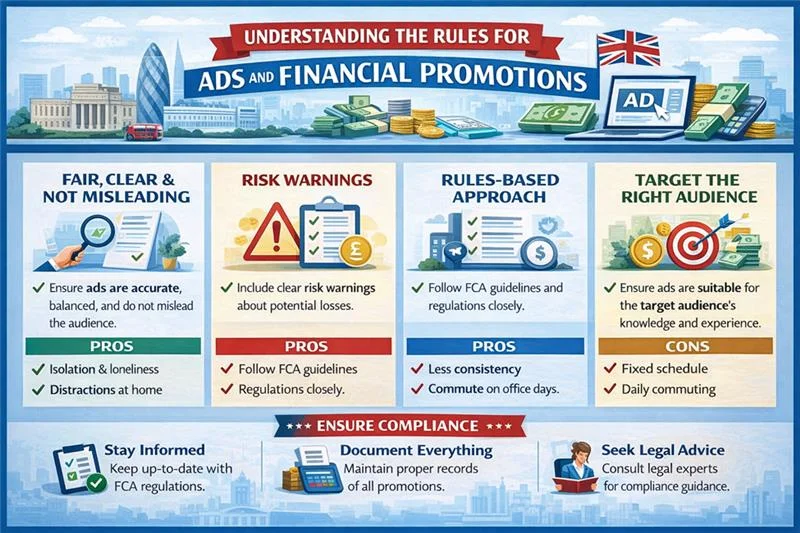

Understanding the Rules for Ads and Financial Promotions

Accounting and financial ads have special rules from groups called the ASA and the FCA. Since early 2025, the ASA has used AI tools to scan thousands of social media posts and check that they are “legal, honest, and true.”

What this means for accountants posting online:

- You cannot promise “big tax savings” without facts to back the claim up

- Every single post must comply with the law on its own, you cannot rely on a linked page to fill in the gaps

- Risk warnings must be visible and cannot be hidden behind a “see more” button

- You must show the downsides of a plan just as clearly as you show the benefits

- Paid ads must include #Ad at the very top so everyone knows it is a commercial

This is especially hard on short-form platforms like X or Instagram, where you have very little space to write.

Doing the Right Thing in the Digital World

Being a good accountant in 2026 is about more than just following laws. It is about helping the whole community. New ethics rules say accountants must use an “inquiring mind” and be careful when using AI tools.

This means not just accepting a computer’s answer if it looks wrong. This problem is known as “automation bias.” Being professional also means standing up against bullying or harassment online. Accountants should help create a kind online environment and make sure their own profiles look credible and trustworthy. They must always be honest, especially when people ask for “quick tips” that might be too simple for a complicated tax situation.

Where to Find People Online in 2026

In 2026, picking the right platform depends on who you want to reach. Here is a quick guide to the best social channels for accountants in the UK. Platform Guide for UK Accountants

| Platform | UK Users (2026) | Best For | ROI Benchmark |

|---|---|---|---|

| 45 million | B2B networking and thought leadership | 229% | |

| YouTube | 54.8 million | Educational content and authority building | 24x for Live |

| 33.4 million | Brand awareness and the creator economy | High (Reels) | |

| 38.3 million | Local targeting and SME groups | 29% ROAS | |

| TikTok | 24.8 million | Reaching Gen Z entrepreneurs | 4.25% engagement |

Quick platform guide:

- LinkedIn is still the top choice for B2B in the UK. A “Social Selling Score” now helps accountants track how well they are building connections.

- Facebook and Instagram are better for reaching local shop owners or self-employed individuals.

- YouTube is the second biggest search platform. It is the gold standard for longer videos that explain big tax changes clearly.

- TikTok is great for fast discovery, especially among younger entrepreneurs and sole traders.

Case Study: How We Used Every Platform with a Purpose

The challenge: Stop posting the same content everywhere and make each platform work harder.

What we did:

Rather than sharing the same post across all channels, we gave each platform a specific job in our client-building funnel.

| Platform | Our Specific Use |

|---|---|

| Shared thought leadership on new “Growth and Skills” rules for decision-makers at large companies. | |

| YouTube | Created full “Masterclass” lessons as a permanent library of educational content. |

| Cut YouTube videos into 60-second clips to pull viewers back to the main hub. | |

| Targeted sole traders and small business owners with MTD deadline reminders. |

Why it worked: People in the UK jump between about six different platforms every day, spending over 90 minutes scrolling. By being visible everywhere with relevant content, we made sure we were never forgotten. When a business owner finally got fed up with confusing tax laws, we were the first name that came to mind

“The A8OM team understands that being an accountant is more about trust than just doing hard maths. Your LinkedIn posts gave us the confidence we needed to get through all the big changes in the 2025 Budget. It felt like someone was guiding our business through a major transition, rather than us trying to figure it all out alone.” – James Whitfield, Director, Midlands Construction Group

Finding New Clients: Turning Strangers into Leads

In 2026, the internet is loud and people scroll fast. To find new clients, you have to offer something truly useful in exchange for an email address. Forget plain “Tax Tips” PDFs. The best firms now build interactive tools and quizzes that solve a real problem for a specific group of people.

Research from 2025 shows that “Interactive Checklists” and “Compare Your Business” reports get far more sign-ups than plain documents. The best lead magnets convert 35% of visitors into leads. But the real key is the follow-up. You must turn a quick “hello” into a real relationship. Send helpful automated emails that keep giving good advice. Don’t just ask for a sale. Online video classes and live demos have become the top way to win new business and generate a real return on investment.

Top Lead Magnets for Accountants in 2026

| Lead Magnet | Conversion Rate | Best Platform |

|---|---|---|

| MTD Readiness Assessment | 35% | LinkedIn / Meta Ads |

| Industry Benchmarking Tool | 22% to 32% | |

| 2025 Budget Impact Calculator | 25% | Google / LinkedIn |

| VAT Threshold Monitor | 18% | Meta (Instagram) |

| Year-End Financial GPS | 15% to 28% | Email / Social Bio |

The Big Tax Change: Making MTD Feel Less Scary

April 2026 brings the biggest change to UK taxes in thirty years because of Making Tax Digital. For accountants, this is not just a challenge. It is a great chance to help people and grow the business.

Common MTD myths your social media should bust:

- Myth: MTD is a new tax. Fact: It is just a new way to send information to HMRC.

- Myth: It means more paperwork. Fact: Good apps auto-sort receipts and link straight to your bank.

- Myth: Only big companies need to worry. Fact: Sole traders with over £50,000 income are affected from April 2026.

Since half of all business owners feel nervous about using new tech, social media content needs to be extra friendly and patient. Quarterly updates can feel manageable with the right guidance.

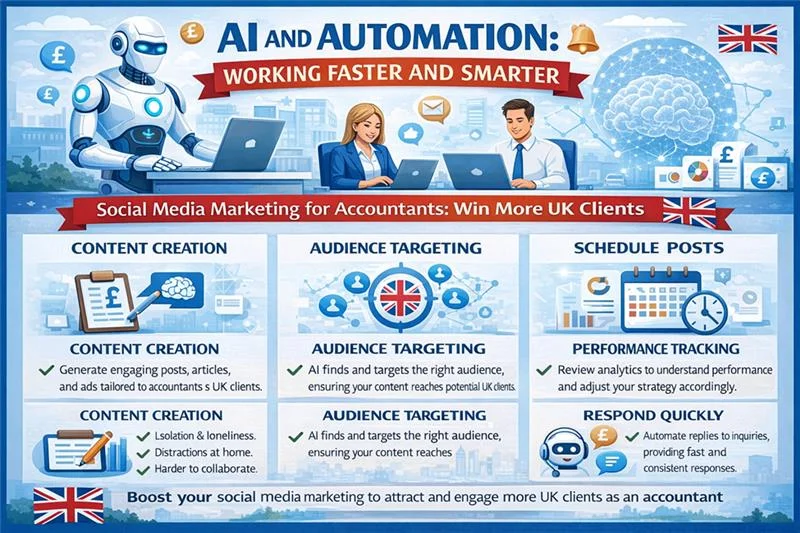

AI and Automation: Working Faster and Smarter

By 2026, using AI in a UK accounting office is as normal as using a calculator. Over half of all companies want to spend more on AI technology this year.

What AI can do for accountants on social media:

- Schedule and publish posts at the best times

- Answer simple enquiries before a human need to get involved

- Create first drafts of content for a qualified person to review

- Tailor messages for different client types at scale

What AI cannot replace:

- A real person checking that tax information is accurate

- The human judgement needed for complex client situations

- Professional accountability for anything published online

The best approach for 2026 is to use AI for quick research and first drafts. But always have a real person review the final content. This way it sounds human and trustworthy.

Making Sense of the 2026 Budget Changes

The UK’s financial world looks quite different now, thanks to the 2025 Budget. Here is a quick summary of what changed and how accountants can turn each change into useful content. Key 2026 Budget Changes and Content Opportunities

| Budget Item | 2026 Impact | Content Idea |

|---|---|---|

| Dividend Tax | Up 2% from April 2026 | “The New Dividend Strategy: Mitigating the 2026 Hike” |

| National Living Wage | Rises to £12.71 for over 21s | “Managing Margin Squeeze: 5 Tips for Retail/Hospitality” |

| EMI Scheme | Expanded to 500 staff | “Scaling Sustainably: Using Shares to Retain Talent” |

| Business Rates | 2026 Revaluation in effect | “Navigating the 2026 Reval: Is Your Business Protected?” |

| Electric Vehicle Tax | New Pay-per-Mile charges | “The True Cost of Your Fleet: Managing the New EV Levies” |

The government is also keeping tax thresholds frozen until 2031. As people earn more, they move into higher tax brackets. Experts call this “fiscal drag.” Accountants can help by explaining this “Triple Whammy” of high wages, energy bills, and interest rates.

But it is not all bad news. There are new perks for companies with up to 500 workers. Talking about green topics like the new EV tax shows that your firm is a forward-thinking partner.

Are Your Posts Actually Making Money?

In 2026, getting a lot of “likes” doesn’t mean much if your bank account is empty. Smart accountants track real numbers, not vanity metrics.

The metrics that matter:

- CPL (Cost Per Lead): How much does it cost to generate one enquiry?

- CLV (Client Lifetime Value): How much is each client worth over the years?

- Time to sign: How quickly do leads decide to hire you after first contact?

- Source attribution: Which specific post led to a signed contract?

Early 2025 research showed that LinkedIn is still the top platform for accounting firms when measuring actual business returns. Thanks to new tracking tools, you can now see exactly which post led to a signed contract.

Finding the Best People to Join Your Team

By 2026, social media is about more than just finding clients. It is also how you find great colleagues.

Most of the UK workforce is now Gen Z and Millennials. They check Instagram, TikTok, and LinkedIn to see if your office is a good place to work before they apply.

What your social media needs to show future hires:

- Happy team members talking about their real experiences

- A clear focus on employee wellbeing and flexibility

- The modern AI tools and technology your team uses every day

- Real career progression, not just a job description

A “Day in the Life” video from a real employee is far more convincing than a standard job advert. It shows future hires that your firm is the place to be.

How A8OM Help UK Accounting Firms Grow

We are a specialist growth team for UK accounting firms that need a real plan for the digital world. We are not a typical agency. We combine big strategy, creative content, and technical skills into one complete package. We help strangers go from just seeing your name online to booking a real meeting with you.

Here is exactly what we do:

1. LinkedIn Partner Profile Management

We take over the LinkedIn profiles of a firm’s partners. We create smart posts and visual slide content that turns leaders into recognised thought leaders. Partner profiles consistently outperform company pages, and we make sure yours does too.

2. Paid Ad Campaigns That Generate Real Leads

We build lead generation campaigns on LinkedIn, Facebook, and TikTok. We use simple, built-in lead forms so people can sign up in seconds, with no extra barriers in the way. Every ad goes through our compliance filter to meet ASA and FCA rules.

3. Always-On Content Calendar

We build a monthly social media plan that balances serious tax content with human, relatable stories. This keeps your firm visible and relevant when a client is ready to choose an accountant.

4. Full Funnel Integration

We make sure your social media connects to your office systems. This includes building landing pages and linking them to your email tools and CRM so that no new lead ever slips through the cracks.

Conclusion

Social media marketing for accounting firms is changing fast in 2026. The profession now sits right at the centre of a big digital and ethical shift. Firms can no longer grow through unplanned or occasional posting. Success now needs a clear method that uses data to improve both technical tax knowledge and an understanding of how people behave online.

The firms that will do their best in 2026 are those that invest in interactive lead magnets and AI tools. They must also stay in GDPR compliant, keep all advertising within professional standards, and never sacrifice the “Inquiring Mind.” Those firms won’t just survive this turning point. They will shape the future of the UK accounting profession.

Frequently Asked Questions

Openness is the keyword under the 2025/26 professional standards. You need to make it clear that a post was heavily written with AI. But more importantly, you should confirm that it had a technical accuracy check by a qualified person. This follows the “Inquiring Mind” principle and stops the spread of inaccurate tax advice.

This rule requires every social media post to stand on its own. A link in the bio or a previous post will not be enough to communicate risks. Any necessary context or links should appear in the comments section. The material visible in a single post must include everything the reader needs, with no hidden content behind a “see more” button.

Yes, but with some caveats. TikTok works well as a discovery platform for the 64% of Gen Z users who browse products and services through content on the platform. It works well for reaching sole traders and the creator economy. But the content must be genuine and concise, such as short “Tax Hacks” or “MTD Basics” videos.

Sole traders and landlords with gross receipts of at least £50,000 will be affected by the April 2026 deadline. Limited liability partnerships and limited companies are currently exempt from this round of the MTD rollout. But they still fall under MTD for VAT if their turnover is above £90,000.

The main risks are a lack of openness and failure to get clear permission for secondary use purposes. Make sure the Privacy Policy link in your form is up to date, and that no consent box is pre-ticked. You should also store any data you capture in a secure CRM system and remove it from the social platform as soon as possible.

For LinkedIn, two to four posts per week is the sweet spot for most UK firms, while Instagram and Facebook work best with three to five posts per week. YouTube suits a slower pace, with one strong video per month. Consistency matters far more than volume, so a steady rhythm always beats posting in bursts and then going quiet.

Educational content that solves a real problem consistently outperforms promotional posts. Short videos on tax changes, carousel posts breaking budget updates, and interactive tools like MTD readiness quizzes all perform well. Behind-the-scenes team content also builds strong trust with potential clients.

Organic content builds trust and keeps you visible with people who already follow you, while paid ads let you reach a brand new audience fast. The smartest approach is to use organic posts to warm up your audience and paid ads to push specific offers like lead magnets or free consultations. Most growing firms use both at the same time.

Paid ad campaigns can start generating enquiries within two to four weeks if the targeting and offer are right. Organic content takes longer, usually three to six months before you see a steady flow of inbound leads. Combining both gives you quick wins from ads while organic content builds long-term authority.

Never make specific tax saving promises without facts to back them up, as this can breach ASA and FCA rules. Avoid sharing anything that hints at a client’s situation, even without naming them, as this risks breaking GDPR confidentiality rules. Also steer clear of political opinions and never leave comments or messages unanswered, as both can quietly cost you clients.